The Digital Payment Revolution Is Here

Property managers who accepts online rent payments are seeing dramatic improvements in their cash flow and tenant satisfaction. The days of chasing down paper checks, dealing with "lost in the mail" excuses, and making trips to the bank are quickly becoming a thing of the past.

Quick Answer: How to Accept Online Rent Payments

- Choose a platform - Select from dedicated rent payment services, property management software, or payment processors

- Set up your account - Connect your bank account and verify your identity

- Invite tenants - Send payment invitations via email or text

- Configure payment rules - Set due dates, late fees, and accepted payment methods

- Go live - Start collecting rent digitally with automatic deposits

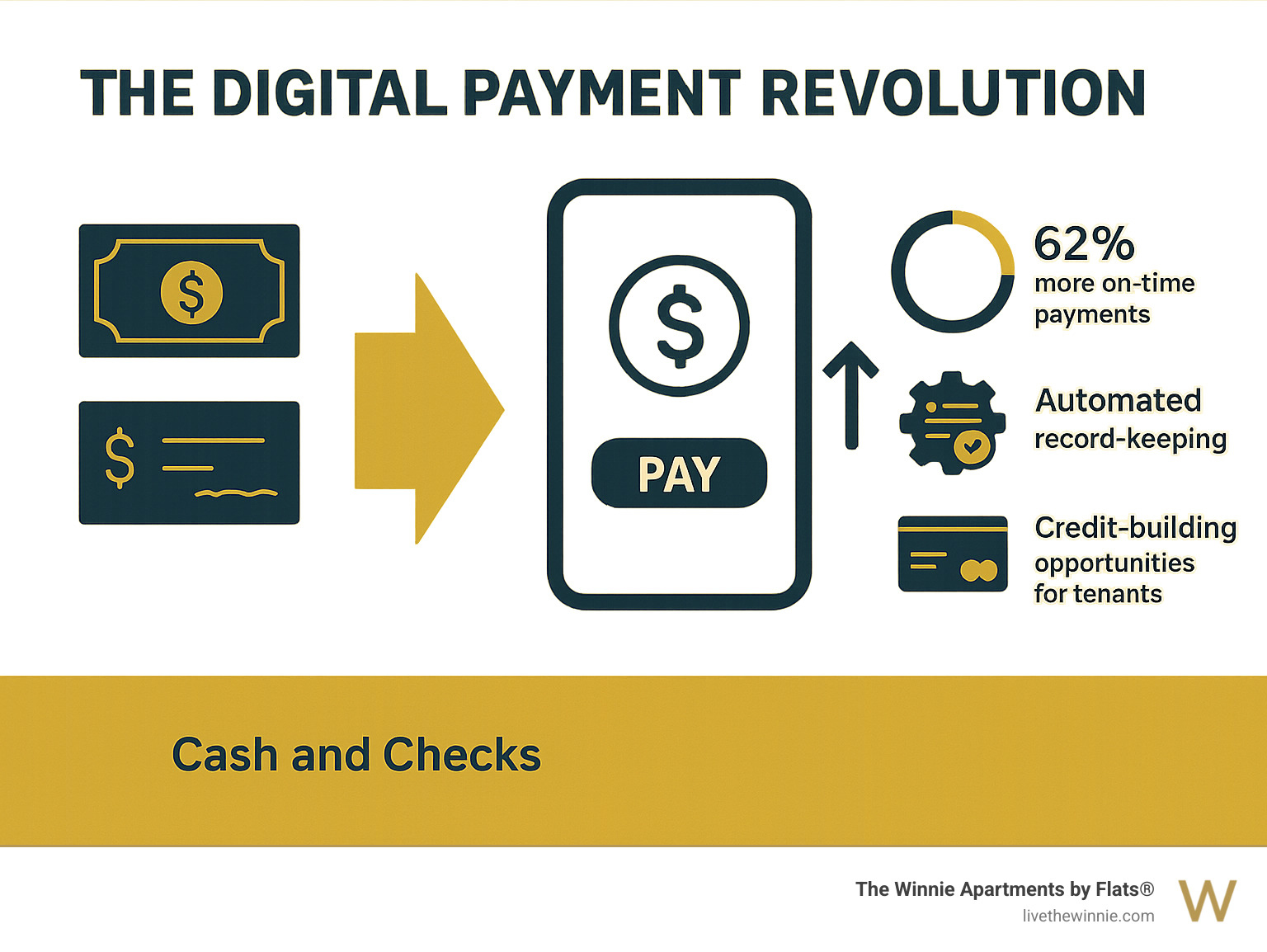

The numbers tell the story: tenants are 62% more likely to pay on-time when using digital payments versus checks and cash. Over $2 billion in rent payments have been processed through online platforms, with some property managers seeing online payment adoption rates jump by over 90% after implementation.

The shift makes sense when you consider the pain points of traditional rent collection. Paper checks can get lost, bounce, or arrive late. Cash payments require in-person handling and create security risks. Digital payments solve these problems while offering benefits like automatic record-keeping, faster fund availability, and the ability for tenants to build credit history.

What Are Online Rent Payments & How They Work

When your property accepts online rent payments, you're tapping into a sophisticated network of financial systems that have revolutionized how money moves in the digital age. Think of it as the modern version of mailing a check, but instead of relying on the postal service, your payment travels through secure digital highways designed specifically for moving money safely and quickly.

The backbone of this system relies on several key networks working together seamlessly. The ACH (Automated Clearing House) network handles the heavy lifting for bank-to-bank transfers, processing an impressive 29 billion payments each year. Meanwhile, card rails - the invisible infrastructure behind Visa, Mastercard, and other major card networks - enable those lightning-fast credit and debit card transactions you're used to. Digital wallets like Apple Pay and Google Pay add another layer of convenience, securely storing your payment information right on your phone.

When you hit "pay rent" on your phone, several things happen almost instantly. The system first verifies who you are and confirms your payment method is valid. For bank-to-bank transfers, this means checking your account details and making sure you have enough funds. Card payments get real-time approval from your bank. Then comes the clearing process - ACH payments typically take 1-3 business days to fully settle, while card transactions can appear almost immediately.

Behind all this convenience, multiple security layers work around the clock to protect your money. Encryption scrambles your sensitive data during transmission, making it completely unreadable to anyone trying to intercept it. Tokenization replaces your actual account numbers with unique, meaningless identifiers, so your real payment details never sit on servers where they could be vulnerable.

Inside the Transaction Pipeline

Every time you make a payment, three key players work together like a well-choreographed dance. Payment gateways act as the welcoming front door, securely capturing your payment information and routing it to the next step. Payment processors do the heavy lifting - they're the ones actually talking to banks, card networks, and the ACH system to move your money where it needs to go. Finally, verification systems run multiple checks on everything from your account balance to potential fraud indicators before giving the green light.

Behind-the-Scenes Security Layers

Modern payment systems take security seriously, implementing PCI-DSS (Payment Card Industry Data Security Standard) compliance, which requires strict protocols for handling any card data. Two-factor authentication adds an extra verification step - you might receive a text message or need to confirm through a mobile app before your payment goes through. Data encryption ensures that even if systems were somehow compromised, any stolen information would be completely useless to attackers.

Why Go Digital: Benefits for Landlords & Tenants

Making the switch to digital payments creates a win-win situation that transforms the entire rent collection experience. That 62% improvement in on-time payments we mentioned earlier is just the tip of the iceberg when it comes to the advantages both landlords and tenants enjoy.

Property managers who accepts online rent payments find that their cash flow becomes much more predictable. Same-day funding options mean rent money arrives in your account faster than traditional checks, which can take days to clear. Gone are the manual tasks of creating receipts and tracking who paid what - automatic receipts handle all the documentation instantly.

The complete audit trail that digital payments create makes tax season and financial reporting significantly easier. Every transaction is timestamped and recorded, creating a clear paper trail that accountants love. Plus, there's an often-overlooked benefit: going paperless with rent collection is genuinely eco-friendly, eliminating hundreds of paper checks and envelopes throughout the year.

Tenants experience a completely different level of convenience with 24/7 payment access right from their phones. No more scrambling to mail checks or worrying about whether payments arrived on time. Many platforms now offer split payment options, which is a game-changer for roommates who want to pay their individual portions directly rather than coordinating one payment.

Perhaps the most exciting development for tenants is the opportunity for credit building. Some services now report on-time rent payments to major credit bureaus, meaning responsible renters can actually improve their credit scores just by paying rent consistently.

Landlord Wins

The operational improvements for property managers are remarkable. Fewer late payments translate directly into more stable cash flow and less time spent on collection efforts. Automated bookkeeping features sync seamlessly with popular accounting software, eliminating hours of manual data entry each month.

During challenging situations like eviction proceedings, digital payment systems offer important controls. You can prevent tenants from making partial payments that might complicate legal processes, ensuring everything stays properly documented for court requirements.

Tenant Wins

The convenience factor for tenants cannot be overstated. 24/7 access means they can pay rent at midnight on a Sunday if they want to, without worrying about business hours or mail delivery times. Split payment features have become incredibly popular, especially in shared living situations. Roommates can each handle their own portion of the rent directly, eliminating the need to coordinate who's collecting money from whom.

The credit score benefits are becoming increasingly important as more services report rental payment history to credit bureaus. For tenants who consistently pay on time, this can provide a significant boost to their credit profile over months and years.

Top Methods & Platforms That Accept Online Rent Payments

When you're ready to accept online rent payments, you'll find several different payment methods available, each designed to meet different needs and preferences.

The most common approach uses ACH and electronic fund transfers as the foundation. These bank-to-bank transfers move money directly from your tenant's account to yours using routing numbers and account details. They're reliable and cost-effective, though they do take a bit longer to process.

Credit and debit cards offer a faster alternative. When tenants pay with cards, the money moves through networks like Visa and Mastercard, giving you instant confirmation that payment went through. The trade-off is higher processing fees, but many landlords find the speed and convenience worth it.

Digital wallets like Apple Pay and Google Pay are becoming increasingly popular, especially with younger renters who prefer mobile-first experiences. These platforms add extra security through features like fingerprint authentication and tokenization.

There's even an interesting option for tenants who prefer cash - some platforms partner with retail networks where tenants can pay cash at participating stores. The system then converts that cash to an electronic payment and deposits it directly to your account.

| Payment Method | Typical Fees | Processing Time | Pros | Cons |

|---|---|---|---|---|

| ACH/EFT | $0-$3 | 1-3 business days | Low cost, reliable | Slower processing |

| Credit Cards | 2.5-5% | Instant | Immediate confirmation | Higher fees |

| Debit Cards | $5-$10 flat | Instant | Fast, lower fees than credit | Still higher than ACH |

| Digital Wallets | Varies | Instant | Very convenient | May have limits |

ACH & EFT: The Workhorse That Accepts Online Rent Payments

ACH transfers handle the bulk of rent payments because they make financial sense for everyone involved. These transactions use the same banking infrastructure that processes payroll deposits and bill payments - it's proven, reliable technology that keeps costs low.

The process works by connecting your tenant's bank account directly to yours through routing and account numbers. Once initiated, payments typically take one to three business days to complete, which is perfectly fine for scheduled rent payments.

The main thing to watch out for is NSF (non-sufficient funds) situations. Just like with paper checks, if a tenant doesn't have enough money in their account, the payment will bounce back. Most modern platforms handle this automatically and can even charge returned payment fees according to your lease terms.

Cards & Wallets: Faster Ways Your Building Accepts Online Rent Payments

Credit and debit card payments shine when speed matters most. The authorization happens in real-time, so you know immediately whether the payment went through successfully. This instant confirmation can be especially valuable for last-minute payments or when tenants are trying to avoid late fees.

The Visa and Mastercard networks that process these payments are incredibly fast and reliable. Many platforms can deposit card payments to your account the same day or next business day, which is much faster than traditional ACH transfers.

Digital wallets take card payments a step further by adding convenience and security. When tenants use Apple Pay or Google Pay, they're not actually sharing their card numbers with the payment system. Instead, these platforms use tokenization to create unique identifiers for each transaction, making them more secure than traditional card payments.

Can Accepting Online Rent Payments Help Build Credit?

This might be the most exciting benefit for your tenants. Many modern rent payment platforms now report payment history to credit bureaus, which means on-time rent payments can actually help tenants build or improve their credit scores.

Think about it - rent is usually someone's largest monthly expense, often more than car payments or credit card bills. Having those payments count toward credit history can make a real difference, especially for younger renters or those trying to rebuild their credit.

Some platforms include this credit reporting automatically at no extra charge, while others offer it as an optional service. The impact can be significant over time. Scientific research on credit-reporting and financial health demonstrates that including rent payments in credit reports helps millions of people establish stronger credit profiles.

For tenants who are working to improve their financial standing, this feature can be a compelling reason to choose properties that accept online rent payments with credit reporting capabilities.

Setting Up & Managing Online Rent Payments Like a Pro

Making the switch to digital payments isn't just about picking a platform and hoping for the best. The properties that accept online rent payments most successfully take a thoughtful approach to setup and ongoing management.

Your first step should be updating your lease agreements and payment policies. Be crystal clear about which payment methods you'll accept, when rent is due, and how late fees work. Don't worry - you can still offer traditional payment options during the transition.

Platform selection deserves careful attention beyond just comparing fees. Costs matter, but think about the bigger picture. Does the platform integrate with your property management software? How's their customer support when things go wrong? What security features do they offer?

Tenant onboarding can make or break your adoption rates. Send clear, step-by-step instructions via email or text. Consider hosting a brief demo session in your community space - many tenants learn better when they can ask questions in person.

Don't forget about the ongoing management pieces. Set up reminder automation so tenants get friendly nudges before rent is due. Configure your partial payment settings and late fee triggers based on your lease terms. If you're dealing with eviction proceedings, make sure you understand how to use eviction hold features that prevent partial payments from complicating legal processes.

For more detailed guidance on managing tenant relationships and payment policies, check out our FAQs for additional insights.

Legal & Regulatory Checklist

Every state has its own quirks when it comes to electronic payments. Some states put caps on the fees you can charge tenants for digital payments. Others require that you always offer at least one free payment option - usually ACH transfers or traditional checks.

Fair Housing laws apply to payment methods too. You can't offer different payment options to different tenants based on protected characteristics. NACHA rules govern ACH transactions and include specific requirements for getting tenant authorization and keeping records. Data privacy laws are evolving rapidly, especially at the state level.

Security & Fraud Prevention

TLS encryption should be table stakes - this protects data while it's moving between systems. Role-based access controls mean you can give your leasing staff access to payment information without giving them the keys to everything else.

Tokenized storage is a fancy way of saying that actual payment details are never stored in readable format. Even if someone breaks into the system, they'd find meaningless tokens instead of real account numbers.

The reality is that digital payments are far more secure than paper checks. Checks have your bank account number printed right on them, can be stolen from mailboxes, and are surprisingly easy to forge.

Troubleshooting, Fees & Advanced Tips

Let's be honest - even the best payment systems sometimes have hiccups. Understanding how fees work and knowing what to do when things go sideways will save you headaches down the road.

Transaction fees are probably your biggest consideration when choosing how to accepts online rent payments. ACH transfers usually come with flat fees (often just a few dollars) or sometimes no fees at all. Credit card payments? That's where things get pricier - you're typically looking at percentage-based fees that can add up quickly on larger rent payments.

Here's where it gets interesting: some platforms let you absorb these costs as a business expense, while others allow you to pass them through to tenants. The choice affects both your bottom line and tenant satisfaction, so think it through carefully.

Chargebacks can be a real pain when they happen with card payments. This is when a tenant disputes a charge with their credit card company, and suddenly you're dealing with paperwork and potential fund reversals. The best defense? Keep detailed records of all transactions and communications.

Failed ACH payments work differently - they're more like bounced checks. Instead of chargebacks, you'll typically see returned payment fees. The good news is that most modern platforms handle these automatically and can even charge the appropriate fees to the tenant's account.

Don't forget about processing delays during holidays and weekends. Banks don't work 24/7, even if your payment platform does. A payment submitted on Friday afternoon might not settle until Tuesday if Monday is a holiday.

Common Cost Scenarios

The fee structure you choose can make a real difference in your overall profitability. Flat-rate fees work great when all your units have similar rent amounts. Percentage-based fees might be more economical if you have a mix of studio apartments and larger units with varying rent prices.

The big question many property managers wrestle with is who pays the fees - you or your tenants? Some states actually restrict your ability to pass fees through to tenants, while others leave it up to market forces.

Speed of Funds & Cut-Off Times

Same-day ACH has been a game-changer for cash flow management. If you submit transactions before the daily cut-off (usually early afternoon), funds can arrive the same day. Instant card payouts can get money to your account within minutes, though they typically cost more.

Weekend delays are still a reality with traditional banking. That Friday evening rent payment might not show up in your account until Monday or Tuesday, depending on holidays.

Handling Partial Payments, Late Fees & Evictions

This is where things get legally tricky, and the right platform features become crucial. Payment blocks during eviction proceedings prevent tenants from making partial payments that could complicate your legal case. In many states, accepting even a partial payment can reset eviction timelines.

Automated late fee calculations ensure you're consistently applying your lease terms without having to remember to add fees manually.

Frequently Asked Questions About Online Rent Payments

Let's tackle the most common questions we hear from property managers and tenants who are considering making the switch to digital payments. These are the real concerns that come up when accepts online rent payments becomes part of your rental strategy.

How quickly will I see funds in my account?

The speed depends on which payment method your tenant chooses. ACH payments are the most common option, and they typically show up in your account within 1-3 business days. It's not instant, but it's reliable and predictable.

Card payments move much faster - you'll usually see those funds the same day or next business day. Some platforms even offer same-day ACH processing if the payment gets submitted before the daily cut-off time, which is usually around 2:45 PM Eastern.

Want funds even faster? Many platforms now offer instant payout options that can put money in your account within minutes. Just keep in mind these premium services often come with higher fees, so you'll want to weigh the speed benefit against the extra cost.

Weekend and holiday timing can slow things down a bit. A payment submitted Friday afternoon might not settle until Tuesday if Monday happens to be a bank holiday.

Are online rent payments really more secure than checks?

Absolutely yes - and it's not even close. Think about what happens with a paper check: your bank account number and routing number are printed right there for anyone to see. Checks can get stolen from mailboxes, lost in transit, or even altered by someone with bad intentions.

Digital payments work completely differently. They use encryption to scramble your financial information during transmission, making it unreadable to anyone trying to intercept it. Tokenization replaces your actual account numbers with unique codes, so your real banking details never get stored on servers.

Most platforms also include fraud monitoring systems that watch for suspicious activity patterns. You get detailed transaction records for every payment, and you can track everything in real-time. Try doing that with a paper check sitting in someone's mailbox.

The security features are constantly being updated to stay ahead of new threats. It's like having a team of cybersecurity professionals protecting every rent payment.

What happens if a tenant's payment fails?

Failed payments happen, but modern systems handle them smoothly with automatic notifications and clear next steps for everyone involved.

ACH payment failures typically show up within 1-2 business days as an NSF (non-sufficient funds) return - basically the digital version of a bounced check. Most platforms will automatically charge the tenant a returned payment fee and send notifications to both of you about what happened.

Card payment failures usually happen immediately and are easier to troubleshoot. The payment might fail because of insufficient funds, an expired card, or fraud protection that kicked in. These are often quick fixes once the tenant updates their payment information.

The best part about digital systems is the automatic communication. Both you and your tenant get instant notifications when something goes wrong, along with clear instructions on how to resolve the issue. No more wondering if a check got lost in the mail or playing phone tag to figure out what happened.

Many platforms also offer retry options, so tenants can quickly submit a new payment once they've resolved whatever caused the initial failure.

Conclusion & Next Steps

The future of rental payments is digital, and the benefits are too significant to ignore. When you accept online rent payments, you're not just upgrading your technology - you're changing how your entire rental business operates. The 62% improvement in on-time payments alone can dramatically improve your cash flow and reduce the stress of chasing down late rent.

Modern renters have come to expect the same convenience from their housing that they get from every other aspect of their lives. They can order food, book rides, and manage their finances from their phones - so why shouldn't paying rent be just as simple?

The time to modernize is now. Every month you delay means missed opportunities for better payment rates, faster fund availability, and happier tenants. The technology is proven, the platforms are mature, and your tenants are ready for the change.

At The Winnie Apartments by Flats®, we've acceptd this digital change as part of our commitment to modern living. Our community in Uptown Chicago combines luxury and affordability with the seamless payment experiences that today's renters expect. We understand that convenience matters, whether it's paying rent from your phone or enjoying our thoughtfully designed amenities.

Your next steps are straightforward: Start by evaluating your current payment collection process and identifying the pain points. Research platforms that match your property size and tenant needs. Plan your rollout carefully, giving tenants plenty of notice and support during the transition.

This change benefits everyone involved. Tenants get convenience and the opportunity to build credit history. You get faster payments, better record-keeping, and more predictable cash flow. It's one of those rare business decisions where everyone wins.

Ready to experience how modern apartment living combines convenience with community? Schedule a tour of The Winnie Apartments by Flats® and see how seamless rent payments are just one part of what makes our community special.

For more information about our community and what makes us different, check out our FAQs page to learn more about calling The Winnie home.